Global Financial Services Industry Outlook?

The top finance companies in the world are contributing to stellar growth in the global financial services industry as of 2020. The financial services industry is expected to reach a value of nearly $26.5 trillion by 2022. Berkshire Hathaway is the largest financial services company in the world — bringing in annual revenues of USD 247.5 billion and with a current asset value of USD 707.8 billion

This fact sheet is to breakdown the top 10 largest finance companies in the world by revenue and asset value as of 2020, but ultimately the goal is to assist business professionals, investors, and people in general that are interested in gaining insights into the global financial services industry including:

- Discover who are the top finance companies in the world by revenue?

- Who is the largest financial services company?

- How much is the financial services industry growth rate?

- What’s the future of the industry?

- Financial services industry stats and trends you should know.

BizVibe is already helping the top finance companies in the world connect. Connect and track the latest news and insights from these companies.

Financial Services Industry Statistics

- In 2018, finance and insurance represented 7.4 percent (or $1.5 trillion) of U.S. gross domestic product.

- The financial services market is expected to reach a value of nearly $26.5 trillion by 2022.

- The financial services industry growth rate will be 6% by 2022.

- The United States exported $114.5 billion in financial services.

- The investment services industry saw year-over-year growth of 41.61% in 2019 of revenues.

- Regional banks saw year-over-year growth of 76.36% in 2019 of revenues.

- Commercial banks saw year-over-year growth of 43.92% in 2019 in revenues.

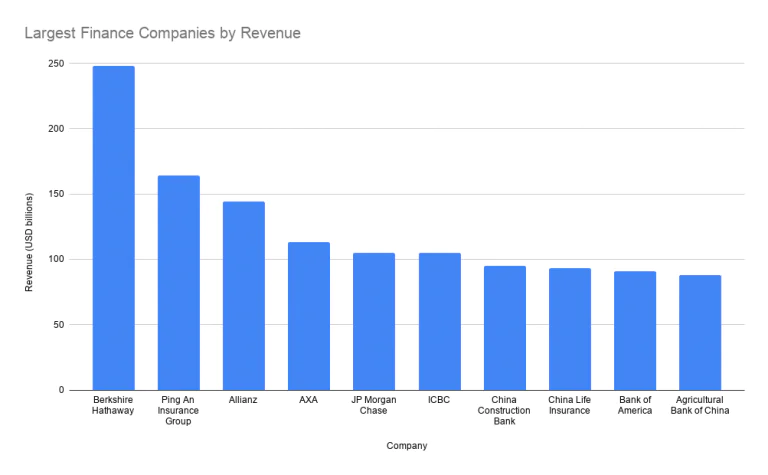

Top 10 Largest Finance Companies in the World by Revenue 2020

Who are the top finance companies by revenue and asset value in 2020? The following is a list of the largest financial services companies ranked by revenue and asset value in USD billion.

Rank |

Company |

Industry |

Revenue |

Total Assets |

Headquarters |

| 1 | Berkshire Hathaway | Conglomerate | 247.5 billion | 707.8 billion | United States |

| 2 | Ping An Insurance Group | Insurance | 163.6 billion | 7,143 billion | China |

| 3 | Allianz | Insurance | 143.9 billion | 973 billion | Germany |

| 4 | AXA | Insurance | 113.1 billion | 1,008 billion | France |

| 5 | JP Morgan Chase | Banking | 105.4 billion | 2,687 billion | United States |

| 6 | ICBC | Banking | 105.4 billion | 4,027 billion | China |

| 7 | China Construction Bank | Banking | 95 billion | 3,376 billion | China |

| 8 | China Life Insurance | Insurance | 92.7 billion | 362 billion | China |

| 9 | Bank of America | Banking | 91.2 billion | 2,325 billion | United States |

| 10 | Agricultural Bank of China | Banking | 87.6 billion | 3,287 billion | China |

Source: https://www.forbes.com/global2000/list/

1. Berkshire Hathaway

Number 1 on the list of the top 10 largest finance companies in the world is holding company Berkshire Hathaway, an American multinational conglomerate led by Warren Buffet — a name synonymous with modern-day investment and success in business. Berkshire Hathaway is headquartered out of Omaha, Nebraska. Who is the largest financial services company in the world? As of 2020, Berkshire Hathaway is the largest financial services company by revenue in the world, with a revenue of USD 247.5 billion last fiscal year.

Berkshire Hathaway’s revenues mainly come from wholly owning or owning a minority stake it multiple top tier companies including GEICO, Duracell, Dairy Queen, BNSF, Lubrizol, Fruit of the Loom, Helzberg Diamonds, Long & Foster, FlightSafety International, Pampered Chef, Forest River, and NetJets. Berkshire Hathaway also has minority holdings in American Express (17.6%), Wells Fargo (9.9%), The Coca-Cola Company (9.4%), Bank of America (6.8%), and Apple (5.22%).

- Founded: 1839

- Berkshire Hathaway Headquarters: Kiewit Plaza, Omaha, Nebraska, USA

- Berkshire Hathaway Asset Value: USD 707.8 billion

- Berkshire Hathaway Revenue: USD 247.5 billion

- Berkshire Hathaway Number of Employees: 389,300

Berkshire Hathaway Products and Services

- Diversified investments

- Property & casualty insurance

- Utilities

- Restaurants

- Food processing

- Aerospace

- Toys

- Media

- Automotive

- Sporting goods

- Consumer products

- Internet

- Real estate

2. Ping An Insurance Group

Number 2 on this list of the top 10 finance companies in the world is Ping An Insurance Group, a Chinese holding conglomerate that deals with insurance, banking, and financial services. Ping An Insurance is considered to be China’s biggest insurer and one of the largest financial services companies by revenue with 2018 revenues surpassing USD 163.6 billion, with an asset value of over USD 7 trillion.

The company was founded 32 years ago in Shenzhen, China, and is one of the top 50 companies in the Shanghai Stock Exchange.

- Founded: 1988

- Ping An Insurance Group Headquarters: Shenzhen, China

- Ping An Insurance Group Asset Value: USD 7,143 billion

- Ping An Insurance Group Revenue: USD 163.6 billion

- Ping An Insurance Group Number of Employees: 190,000

Ping An Insurance Group’s Products and Services

- Life and Health Insurance

- Property and Casualty

- Banking

- Asset Management

- Fintech and Healthtech

3. Allianz

Allianz is the first German company on the list of largest financial services companies by revenue, with annual revenues of USD 143.9 billion and total asset value of USD 973 billion. Allianz is a European multinational financial services company headquartered in Munich, Germany. The company is the world’s largest insurance company as measured by Forbes. Allianz runs its operating in many countries including Canada, the USA, Australia, Belgium, Germany and more. Allianz mainly specializes in asset management and insurance.

- Founded: 1890

- Allianz Headquarters: Munich, Germany

- Allianz Asset Value: USD 973 billion

- Allianz Revenue: USD 143.9 billion

- Allianz Number of Employees: 147,268

Allianz Subsidiaries

- Allianz France

- Allianz Worldwide Care

- Allianz Global Investors

- Risklab

- Allianz Global Assistance

- Allianz Insurance plc

- Allianz Global Corporate and Specialty

- Allianz Life

- Club Marine

- Hunter Premium Funding

- Allianz Marine & Transit

- Euler Hermes

- Mondial Assistance Group

- Allianz Technology

- PIMCO

4. AXA

AXA comes in 4th on BizVibe’s ranking of financial services companies by revenue in 2020. AXA is a French multinational insurance firm headquartered in Paris and is known for its imprint in global insurance, investment management, and other financial services. AXA’s revenues last year were USD 113.1 billion — making it one of the top finance companies in the world by revenue. Additionally, AXA has an asset value of over USD 1 trillion.

- Founded: 1816

- AXA Headquarters: 25 Avenue Matignon, Paris, France

- AXA Asset Value: USD 1,008 billion

- AXA Revenue: USD 113.1 billion

- AXA Number of Employees: 125,934

AXA Products and Services

- Life insurance

- Health insurance

- Property insurance

- Casualty insurance

- Investment management

5. JP Morgan Chase

JPMorgan Chase is an American multinational investment banking company and 5th on BizVibe’s list of the top 10 largest finance companies in the world by revenue. Headquartered in New York City and founded back in 1799 initially as Bank of the Manhattan Company, the company has the third largest hedge fund ion the world.

JPMorgan Chase has total assets of USD 2.68 trillion and their annual revenue last year was 105.4 billion. JPMorgan Chase is one of the big four banks in America, along with Bank of America, Citigroup, and Wells Fargo.

- Founded: 2000

- JPM Headquarters: New York City, New York, United States

- JPM Total Asset Value: USD 2,687 billion

- JPM Revenue: USD 105.4 billion

- JPM Number of Employees: 256,981

6. Industrial & Commercial Bank of China (ICBC)

Industrial & Commercial Bank of China — a multinational Chinese banking company and often referred to as ICBC — is the largest bank in the world and ranks 6th on BizVibe’s list of the top 10 finance companies in the world by revenue. The company is a state-owned enterprise founded 36 years ago in Beijing. ICBC specializes in 3 main types of services: banking, financial services, and investment services.

Industrial & Commercial Bank of China is the largest bank in the world by assets with USD 4.03 trillion in total assets. ICBC is the fourth largest bank in the world going by total revenue at USD 105.4 billion.

- Founded: 1984

- ICBC Headquarters: Beijing, China

- ICBC Total Asset Value: USD 4,027 billion

- ICBC Revenue: USD 105.4 billion

- ICBC Number of Employees: 453,048

ICBC Products and Services

- Finance and insurance

- Consumer banking

- Corporate banking

- Investment banking

- Investment management

- Global wealth management

- Private equity

- Mortgage loans

- Credit cards

7. China Construction Bank

7th on BizVibe’s list of the largest financial services companies in the world is China Construction Bank Corporation — abbreviated as CCB — the company is one of the “big four” banks in China. CCB was founded 66 years ago in Beijing and currently operates branches in Barcelona, Frankfurt, Luxembourg, Hong Kong, Johannesburg, New York City, Seoul, Singapore, Tokyo, Melbourne, Kuala Lumpur, Sydney and Auckland, and has a wholly-owned subsidiary in London.

China Construction Bank is the 2nd largest bank in the world ranked by total by assets at USD 3.37 trillion and the 7th largest financial company in the world by revenue at USD 95 billion last fiscal year.

- Founded: 1954

- CCB Headquarters: Beijing, China

- CCB Total Asset Value: USD 3,376 billion

- CCB Revenue: USD 95 billion

- CCB Number of Employees: 345,971

China Construction Bank Corporation Products

- Finance and insurance

- Consumer Banking

- Corporate Banking

- Investment banking

- Investment management

- Global Wealth Management

- Private equity

- Mortgages

- Credit cards

8. China Life Insurance

8th on BizVibe’s list of the top finance companies in the world by revenue is the Beijing-based Chinese-incorporated company China Life Insurance. China Life Insurance is the biggest life insurer in China and has since expanded to other international markets.

- Founded: 1949

- China Life Insurance Headquarters: Beijing, China

- China Life Insurance Asset Value: USD 362 billion

- China Life Insurance Revenue: USD 92.7 billion

- DaChina Life Insurance Number of Systèmes Employees: 16,055

9. Bank of America

With headquarters in Charlotte, North Carolina, USA, Bank of America is one of the largest banks in the world by assets and revenue. Founded in 1998, Bank of America operates central hubs in New York City, London, Hong Kong, Minneapolis, and Toronto, but was founded in San Francisco. Bank of America specializes in a multitude of services and has total assets of USD 2.32 trillion and total revenues of USD 91.24 billion.

- Founded: 1998

- Bank of America Headquarters: Charlotte, U.S

- Bank of America Total Asset Value: USD 2,325 billion

- Bank of America Revenue: USD 91.24 billion

- Bank of America Number of Employees: 204,489

Bank of America Products and Services

- Consumer banking

- corporate banking

- insurance

- investment banking

- mortgage loans

- private banking

- private equity

- wealth management

- credit cards

10. Agricultural Bank of China

Rounding out BizVibe’s list of the largest financial services companies by revenue is also from China and another one of the big four banks in China. Agricultural Bank of China is 10th on BizVibe’s list of the top finance companies in 2020. ABC has a total asset value of USD 3.287 trillion, making it the 3rd largest bank in the world by assets. Agricultural Bank of China was founded 69 years ago back in 1951 and is primarily owned by Central Huijin and the Ministry of Finance.

In terms of revenue, ABC brought in $87.6 billion in 2018 and continues stellar annual revenues. In 2010, the Agricultural Bank of China went public and its IPO was the largest on record at the time, surpassed since by Alibaba.

- Founded: 1951

- ABC Headquarters: Beijing, China

- ABC Total Asset Value: USD 3,287 billion

- ABC Revenue: USD 87.6 billion

- ABC Number of Employees: 473,691

Agricultural Bank of China Products and Services

- Finance and insurance

- Consumer Banking

- Corporate Banking

- Investment banking

- Investment management

- Global Wealth Management

- Private equity

- Mortgages

- Credit cards

This is BizVibe’s list of the top finance companies in the world in 2020 by revenue. These companies are changing the way businesses are innovating continuing to help grow many industries in the world by providing their financial services.

Reach out to top finance companies today on BizVibe.

Top Finance Companies by Revenue in 2020

In addition to the top 10 finance companies, here is a ranking of the financial services companies outside of the top 10. These companies have the potential of getting into the top 10 in the future. Which one of these companies will reach the top 10 finance companies list in 2021?

Rank |

Company |

Industry |

Revenue (USD millions) |

Net Income (USD millions) |

| 1 | Wells Fargo | Banking | 86,410 | 22,390 |

| 2 | HSBC | Banking | 86,131 | 15,020 |

| 3 | Generali Group | Insurance | 75,460 | 2,310 |

| 4 | People’s Insurance Company | Insurance | 75,377 | 1,952 |

| 5 | Bank of China | Banking | 73,230 | 27,970 |

| 6 | Citigroup | Banking | 72,850 | 16,672 |

| 7 | MetLife | Insurance | 67,940 | 4,982 |

| 8 | Bank of Communications | Banking | 65,644 | 11,131 |

| 9 | Dai-ichi Life | Insurance | 64,794 | 2,029 |

| 10 | Aegon | Insurance | 64,223 | 2,618 |

| 11 | Banco Bradesco | Banking | 61,540 | 5,222 |

| 12 | Prudential Financial | Insurance | 59,689 | 7,863 |

| 13 | Legal & General Group | Insurance | 55,999 | 2,701 |

| 14 | China Merchants Bank | Banking | 55,063 | 12,179 |

| 15 | Munich Re | Insurance | 54,090 | 2,530 |

| 16 | China Pacific Insurance | Insurance | 53,572 | 2,724 |

| 17 | Banco Santander | Banking | 53,340 | 8,600 |

| 18 | Shanghai Pudong Development | Banking | 50,545 | 8,453 |

| 19 | Morgan Stanley | Investment Services | 50,193 | 8,748 |

| 20 | MS&AD Insurance Group | Insurance | 49,609 | 1,738 |

| 21 | Tokio Marine Holdings | Insurance | 49,395 | 2,476 |

| 22 | American International Group | Insurance | 47,390 | -0.006 |

| 23 | Zurich Insurance Group | Insurance | 47,180 | 3,716 |

| 24 | BNP Paribas | Banking | 46,840 | 8,820 |

| 25 | CNP Assurances | Insurance | 45,461 | 1,612 |

| 26 | Sberbank | Banking | 44,898 | 13,268 |

| 27 | Royal Bank of Canada | Banking | 44,609 | 9,635 |

| 28 | Banco do Brasil | Banking | 43,332 | 3,782 |

| 29 | China Minsheng Banking | Banking | 43,298 | 7,370 |

| 30 | American Express | Financial Services | 43,281 | 6,921 |

| 31 | Itaú Unibanco Holding | Banking | 42,700 | 6,500 |

| 32 | Talanx | Insurance | 42,390 | 829 |

| 33 | Goldman Sachs | Investment Services | 42,254 | 4,286 |

| 34 | Mitsubishi UFJ Financial Group | Banking | 41,280 | 9,820 |

| 35 | TD Bank Group | Banking | 41,198 | 8,751 |

| 36 | Allstate | Insurance | 39,815 | 2,252 |

| 37 | State Bank of India | Banking | 39,090 | 120 |

| 38 | Intesa Sanpaolo | Banking | 39,050 | 4,780 |

| 39 | Power Corporation of Canada | Insurance | 37,118 | 1,033 |

| 40 | Swiss Re | Insurance | 37,047 | 462 |

| 41 | Mizuho Financial Group | Banking | 35,406 | 871 |

| 42 | Sumitomo Mitsui Financial Group | Banking | 35,170 | 8,207 |

| 43 | Credit Suisse Group | Investment Services | 34,284 | 2,070 |

| 44 | Crédit Agricole | Banking | 33,747 | 5,351 |

| 45 | Commonwealth Bank | Banking | 33,186 | 7,228 |

| 46 | Sompo Holdings | Insurance | 32,857 | 1,322 |

| 47 | Prudential | Insurance | 32,553 | 4,035 |

| 48 | Standard Life | Insurance | 32,114 | 868 |

| 49 | Bank of Nova Scotia | Banking | 31,589 | 6,642 |

| 50 | Travelers Cos | Insurance | 30,282 | 2,523 |

| 51 | UBS | Investment Services | 30,210 | 4,510 |

| 52 | Manulife Financial | Insurance | 30,070 | 3,703 |

| 53 | Royal Bank of Scotland | Banking | 28,984 | 2,218 |

| 54 | Barclays | Banking | 27,865 | 3,126 |

| 55 | Deutsche Bank | Banking | 27,492 | 378 |

| 56 | Mapfre | Insurance | 27,423 | 624 |

| 57 | ANZ | Banking | 27,147 | 4,863 |

| 58 | Société Générale | Banking | 26,380 | 3,780 |

| 59 | BBVA | Banking | 26,261 | 2,930 |

| 60 | Onex | Investment Services | 25,606 | -0.663 |

| 61 | Lloyds Banking Group | Banking | 25,251 | 5,737 |

| 62 | Aviva | Insurance | 23,180 | 2,197 |

| 63 | FNMA (Fannie Mae) | Investment Services | 21,900 | 16,000 |

| 64 | Aflac | Insurance | 21,758 | 2,920 |

| 65 | UniCredit | Banking | 21,070 | 5,212 |

| 66 | Standard Chartered | Banking | 20,976 | 1,109 |

| 67 | Old Mutual | Investment Services | 20,923 | 938 |

| 68 | Freddie Mac | Investment Services | 15,380 | 9,235 |

| 69 | Westpac Banking Group | Banking | 14,710 | 5,412 |

| 70 | National Australia Bank | Banking | 12,770 | 3,713 |

Source: https://www.forbes.com/global2000/list/

The Future of the Financial Services Industry

What’s the future of the financial services industry? Expect FinTech to drive the new business model going forward as new market entrants look to FinTech disruptors. As digital becomes mainstream, expect new technologies to take over and the top finance companies to continue innovating in the global financial services industry.